Starting our adult lives can be a daunting experience for most people. There are many factors to consider, such as starting a new job, gaining independence, and planning for retirement, all while managing debts and loans.

While past generations may have had it easier, young adults today have a valuable asset on their side: technology. With advances in financial planning softwares and resources, there are today more options than before to help with budgeting and planning.

In this article, we will explore seven budgeting tips for financial planning that can help young adults take control of their finances and create a solid foundation for their future.

1- Start With a Budget

If you want to create a successful financial plan the first step is to create an appropiate budget. This will help you have a clear understanding of you incomes and your expenses.

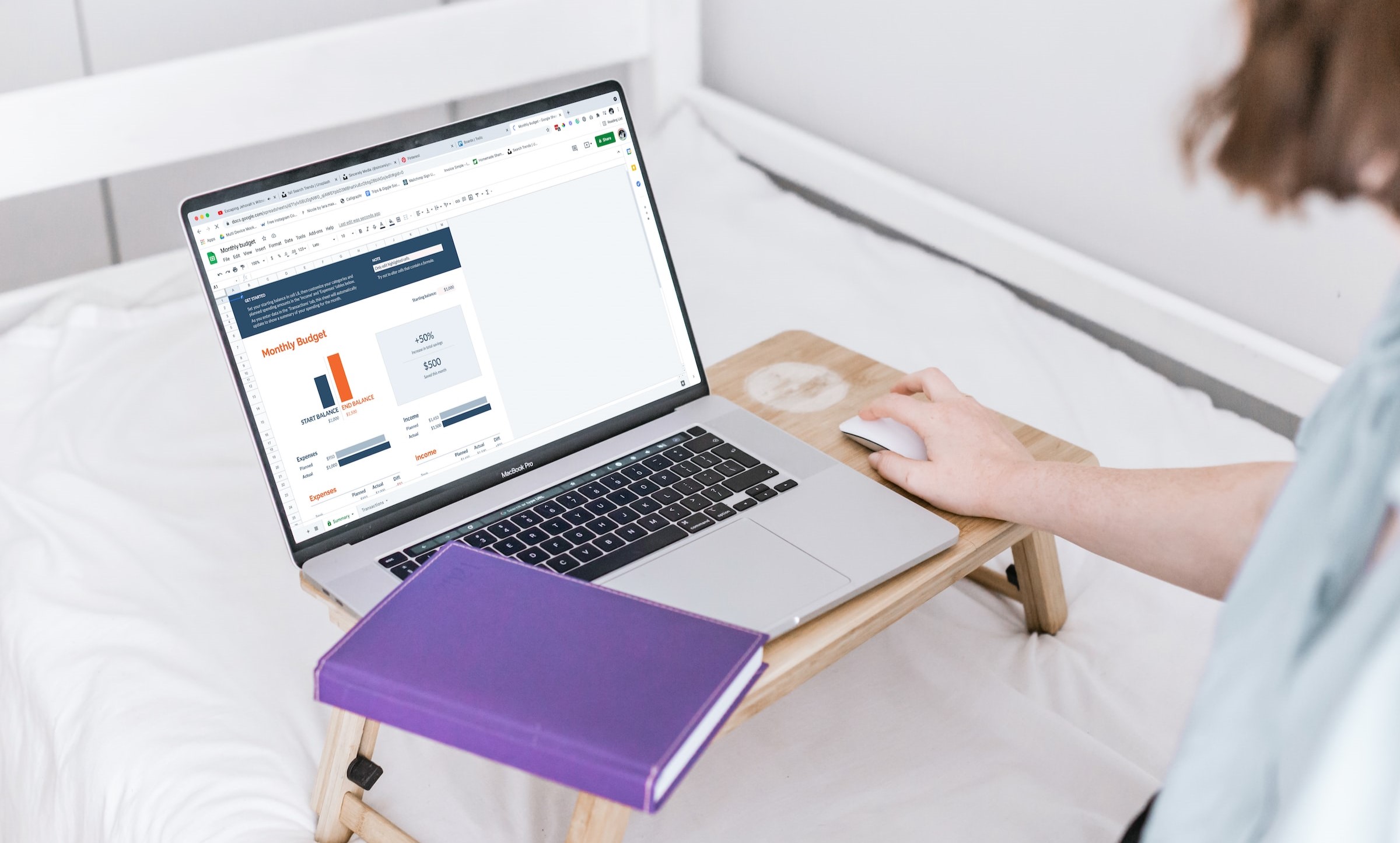

We know that keeping track of your incomes and expenses can be exhausting and time-consuming. However, there are many softwares and applications that can help with this, we have gatherer the Best 7 Financial Management Apps to use in 2023 if you want to know them.

If this is not your case, you can keep track of your incomes and expenses by creating manual lists or use tools as Google Sheets or Excel.

2- Set Financial Goals

Now that you know your incomes and expenses, the next thing you should do is set your financial goals.

Whether it is a family vacation, buying a house or start saving for your retirement you need to have clarity on what your goals are.

I will tell you something, some goals are more important that others. Let´s say that you have a student loan, or any other debt that hasn´t been paid yet, this needs to be your number 1 prority after you created a budget.

A debt is not only an amount of money that you owe to someone, most of the debts work with compound interest, this means that it will increase over time with each late payment.

This is not something we say to freak you out, it is only to be clear that you need to get rid of your debts and loans before thinking about buying a house or going on vacation.

3- Reduce Expenses

The third budgeting tip we have for you is to reduce your expenses. After setting your goals you need to create a plan to follow them, this means it´s time to find the way to make your incomes bigger than your expenses.

With the budget you already created in step 1, you can track your expenses and see which of them are unnecessary and get rid of them.

By getting rid of them we don´t mean that you should stop entertaining and doing hobbies you like, it means that you shouldn´t waste more than recommended, you can follow the 70-30 rule.

This rule is suggested by financial experts that explain that 70% of your income should be taken for necessary expenses like rent and bills, 30% (ideally less) should go to non-essential expenses like entertaining and dining out.

4- Make a Plan for Emergencies, One of The Most Important Budgeting Tips

When creating a budget, make sure to take possible emergencies into account, these can happen anytime.

We all think that unexpected things only happen to other people and we are free of risks, and when these times come they have the capacity to derail almost all budgets.

Financial experts assure that we should allocate between 10-15% of our income in emergencies plan, you can save it in a separate savings account to ensure it doesn´t lose value over time.

5- Use Credit (Wisely)

Credit can be a very helpful tool if you know how to use it, but it can also be a trap if not.

Being responsible with your credits can be very helpfull in the long-term, having a good credit score represents an advantage when you apply for a loan to buy a house, for instance.

Also, credit cards often offer reward programs that you can benefit from on spends that you already planned on making, for example, buying groceries.

However, remember that with credits you need to be very careful, and if you are not completely sure that you can cover these future debts try to avoid them.

6- Invest in Your Future

I know this sounds kind of obvious but, for some people, is not like that.

That you are reading this means you care about your finances, and looking after your budget is already a big step; now its important that you think about your future goals.

One key aspect of financial planning is to give importance to the long-term goals, remember that they can change over time; buying a house, retiring, or even your kids education are things that you should start covering now even if it is not on your plans right now.

7- Seek Advice

Following these tips you will most probably be able to reach your financial goals, however, if you are struggling with your current financial status don´t hesitate to seek for advice.

Remember that there are more experienced people that have already been through the same problems, there is no shame in looking for help.

Conclusion

In conclusion, creating a financial plan is an important aspect to take into account as we become adults.

Taking care of expenses and families was probably easier in past years but new generations count with many tools and new opportunities they can take advantage from.

The ones listed on this article are just an starting point, there are many other budgeting tips you can find and apply on your life as you advance this new stage of your life.

We hope you found this article useful and that it helps you achieve your financial goals. Please let us know if you have any questions, and we will be glad to help

Pingback: Artificial Intelligence in Finances, A Better Way to Manage our Budget %page